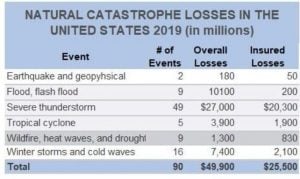

Source data provided by: Insurance Information Institute (III)

Scientists note that natural disasters — hurricanes, forest fires, floods — are increasingly common due to climate change. In 2019, the Insurance Information Institute (III) listed 90 natural disasters in the U.S. that claimed almost $50 billion in damage. Only about half of the losses were actually covered by insurance.

Natural disasters are unpredictable and catastrophic, two conditions that encourage property owners to transfer the risk of devastating losses to insurance companies. The companies subsequently spread the risk of major losses throughout the insurance industry through reinsurance contracts.

Rental Property Owner Risks

A natural disaster exposes a landlord to three types of losses:

- Property repairs and replacement

- Lost income

- Tenant liability claims

Property repairs and replacement

Repairs for structures range from cosmetic damage to the total loss of property. Acquiring the proper insurance coverage for all kinds of natural disasters, including wind and flood, will offset potential financial losses, especially if you do have to sell your property as a result of the natural disaster.

Basic landlord insurance varies on the hazards and amounts of coverage, necessitating a clear understanding of coverage definitions, requirements, and exclusions. Property owners should seek coverage that either replaces lost items as new or compensates the insured with the full replacement value in cash.

Although insurance may relieve some of the pain associated with a natural disaster, landlords should take measures to limit physical damage as much as possible. For example, landlords with property in hurricane-prone areas should keep trees trimmed, install hurricane screens and shutters, and store any physical objects that might be windborne. A landlord with property subject to forest fires needs to create a defensible space when landscaping and have an evacuation protocol that includes turning off utilities.

Lost income

Property is often uninhabitable after a natural disaster until restored. Lessees are forced to seek shelter elsewhere even if they are bound to their lease. Tenants living in states that have adopted the Uniform Residential Landlord and Tenant Act (revised in 2015) are automatically relieved from rent payments after they vacate the property. In either case, property owners should expect tenant resistance to paying rent for property they cannot occupy.

Standard landlord insurance typically does not include rent income lost during tenantless periods. In some cases, property owners can purchase rent loss insurance separately or as a rider. The insurance may extend beyond losses resulting from a natural disaster to any event of lost rent.

Tenant liability claims

Justified or not, tenants may bring claims against their landlords for lost property or physical injury due to a natural disaster. Anticipating claims and taking preemptive actions to avoid or minimize costly lawsuits is the best protection.

Preparing tenants for potential disasters can avoid potential personal and property losses, that might otherwise occur and reinforce tenant relations. Steps to take include:

- Public notices that explain how renters might be affected by a natural disaster including their rights under the Universal Landlord and Tenant Act if applicable.

- Installation of appropriate protections such as smoke and carbon monoxide detectors, fire alarms, fire extinguishers as needed, and security cameras.

- Written evacuation procedures in emergencies with identified safe areas to ensure that all tenants can be located. Each renter should be required to provide off-site contact information in the event of evacuation or displacement.

- Tenant assistance to list, identify, and photograph personal property for insurance purposes.

Preemptive Landlord Actions to Mitigate Natural Disasters

Lost income and claims of liability are usually minimal or absent in most property insurance, though coverage is generally available at an extra expense.

Landlords can avoid potential tenant issues by requiring each tenant to maintain renters insurance as part of their lease to cover lost or damaged property and extra rental costs while they are displaced from the property. This is a relatively inexpensive way to ensure that tenants’ belongings are protected; remind tenants that your insurance will not cover their personal belongings (many tenants assume that it will).

Understanding Insurance Coverages

Property insurance contracts are complex and confusing and filled with paragraph after paragraph of legalese and boilerplate language. Collection on a policy can be especially difficult because most insurance companies resist paying large claims. Property owners often believe they have better coverage than they actually have. For example, flood insurance is not included in a typical policy; it must be acquired separately as a rider or a new policy.

A thorough knowledge of the coverage – what is covered and for how much – is essential for full protection. Just as homebuyers are served by engaging an attorney to review home purchase agreements, landlords engage attorneys who specialize in insurance to look over policies and make recommendations for improvements. Those tempted to disregard an attorney consultation due to expense may find themselves penny-wise and pound-foolish. Good advice from an expert is always beneficial.

A good insurance attorney provides a backstop for your agent, identifying lapses in coverage, saving you money by eliminating contingencies, and possibly protecting you from lawsuits years down the line.

Selecting the Right Insurer

While the insurance agent is the person that property owners and managers most often contact, the company behind the agent is equally important and should be considered. All property insurers and agents are required by law to register with the state and regularly produce financial and consumer reports for the regulating agency to ensure their solvency (ability to play claims as required).

Despite the regulations, insurers significantly vary in size, targeted markets, and customer service. Before agreeing to a contract, property owners should check with their State Insurance Boards and consumer reporting agencies such as the Better Business Bureau for past and current legal actions, complaints, and filings that affect their ability or willingness to deliver the protections advertised.

Recommendations from current property owners who have experience with an insurer should always be investigated.

Cost of Property Insurance

The costs of property insurance can vary significantly from one insurer to the next. Costs for multi-family properties can range from $1,000 to $3,000 per $1 million of value depending on:

- Location of the property. Premiums for property located where natural disasters are frequent and devastating such as California and Florida (fires and hurricanes, respectively) are usually more expensive than in regions of less activity.

- Age and condition of physical property. Older buildings typically lack the latest safety design for structural integrity, fire-resistant materials, and safety systems developed to resist or minimize damage from a natural disaster.

- Current value of property. Premiums typically rise as the value of the property increases, i.e., the premium for a $10 million building is higher than the premium for a $5 million building.

Calculating and maintaining profitability ratios is one way of ensuring that property insurance costs are in line with expectations.

Final Thoughts

In many ways, running a rental property is like running other small businesses. The key to profitability is having good management and the right tools. With those elements in place — including being sure you are protected in the event of a natural disaster — your only worry will be managing your money correctly.