Income verification just got so much easier for Rentec Direct clients looking for more detailed tenant screening options. When ordering your tenant credit, criminal, and eviction reports you can now easily include an automated income verification report.

The income verification report feature provides you a quick and easy way to prove your applicant’s net income. The data comes directly from your rental applicant’s bank account, the most reliable source for verifying income.

Why automate income verification?

As a landlord myself, my first thought when we researched adding this report to our system was: “We don’t need this, applicants simply provide us a copy of their pay stub and that proves their income.” I was wrong.

As I thought about it a bit more, I came to realize there were some flaws in my initial reaction. In an ever-increasing electronic world, most tenants don’t have their most recent pay stubs nicely folded up in their back pocket when they apply for a property. They usually have to go ask their employer for copies, and this can take time, which means longer vacancies or lost tenants.

Second, and perhaps more important; my ten-year-old could, in about five minutes, fabricate a pay stub on his computer showing he makes any -amount he desires per month. If my ten-year-old can do this, so can any applicant. As such, copies of pay stubs are no longer a reliable method of proving income because they can so easily be fabricated. Don’t believe it? Just Google “fake pay stubs” and be astonished how easy it is for a tenant to make one.

If you currently require tenants to bring in pay stubs, you are taking the time to verify their employment. If you ask for bank statements, you are reviewing dozens, or maybe hundreds, of line items to determine what the tenant’s actual income may be. And the forms are different from each and every applicant, making it really cumbersome to quickly get the info you need. Either way, traditional methods are slow, and often error-prone and cost you a lot of staff time.

Another great benefit: these automated income verification reports also include irregular income deposits. These include bonuses, tax returns and things like tips-based income. Finally, there is an easy way for applicants who earn income from tips to substantiate their reported income.

With automated income verification, powered by The Closing Docs and Rentec Direct, you simply check a box during your screening package selection, enter the tenant’s email address, and that’s it! The tenant can quickly complete the process in a matter of minutes either in your office, on their mobile phone, or at home.

How Does it Work?

Income verification is very easy from both your perspective and the tenants. Here are the details:

- When you are choosing a tenant screening package, check the box for Automated Income Verification and enter your tenant’s email address. Your tenant will receive an email a few seconds later with a link to verify their income.

- Your tenant can use their computer or mobile device to securely login to their bank account where their employment net income is deposited.

- Once logged in, the system will generate a report summarizing all deposits as well as identify their employer, in an easy to read report that shows monthly and annual net income figures. The tenant will review the report for accuracy, and they can add an explanatory statement if they wish, but they cannot change the contents of the report.

- A copy of their automated income verification report will be available for you to view next to your other tenant screening reports.

Click here to view a sample report

What does it it cost?

As a Rentec Direct client, you will automatically receive access to wholesale rates for all tenant screening products. Your wholesale access includes substantial discounts on credit, criminal, eviction, and now also automated income verification. The retail rate for automated income verification is about $10, but Rentec Direct clients will see and be charged the wholesale discounted price when ordering this report in the software. Most landlords and property managers choose to pass along the tenant screening costs to their applicants in the form of an application fee.

To run new tenant screening reports, login to your account and select Reports, Tenant Screening. On the package selection page, your discounted rate for automated income verification will be shown.

Also, you only pay for reports that are completed by the tenant. If your tenant doesn’t complete the process, or in the small chance that their bank isn’t supported, you’ll automatically receive a credit for the cost of the report.

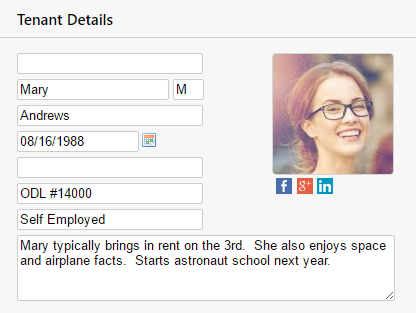

This new feature for screening tenants is almost there. It’s not good for self-employed applicants. I tried the new income verification report and compared it to a bank statement. Checks and cash from applicant’s clients are not included in “Net Income” and instead lumped into “Total Irregular Income” The report does not collect payments received via Venmo, Paypal, or Cash App.

Hi Frank, thank you for trying out the new report. You are right though in that applicants who do not have a regular monthly income are a bit harder to verify. It’s harder if you do it by hand via their bank statements, and it’s also harder for the income verification report to identify regular monthly income if all their income is irregular. I anticipate the majority of renters do have regular income from their jobs though so hopefully this type of income is the exception.

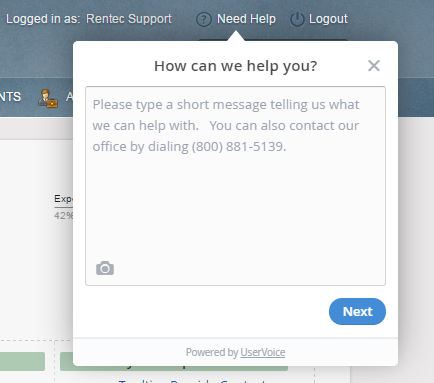

Hi Nathan, I processed the back round check and left the verify income box unchecked. I immediately realized what I did but could not figure out a way to request it without paying the back round check again. Is there a way to do this? Thanks

Hi Laura, that’s a great question. These easy instructions should help you order the income verification without reordering a package.

In your Rentec Direct account:

1. Click Reports.

2. Choose Screening Reports.

3. Now click on that person’s name from the list and click Next.

4. On the next page, instead of choosing a package, click on the Ala-Cart link at the top of the page to be taken to a list of individual reports from which to choose.

Hope this helps. If you have any difficulties with this process feel free to reach out to your Success team available Mon-Fri 6a-5p pst. 800-881-5139 (option 2) // success@rentecdirect.com

I run a LIHTC (Low Income Housing Tax Credit) property which requires me to do income verification like Social security, SSI, Regular income, banking verification etc. Sometimes the SS/SSI income are loaded on to cards and the tenants might not even have bank accounts. How helpful is this feature on such tenants.

We’ve seen the income verification work really well for any prospective tenant that has a checking or savings account where their deposits go to. From what I’ve seen, most social programs, including SSI and SS require direct deposit into a bank account. However, if the tenant does not have a bank account, the tool won’t be effective.

Hi. It would be nice if this service could be ordered after doing the other screenings, without having to do the other screenings again. I would prefer to be able to run credit and then come back and pay $5 more to run the income verification if the other screenings are positive.

Hi Kirby, thanks for writing in with your feedback. The good news is that it is possible to run the income verification separately. When ordering the tenant screening bundle, leave the income verification box unchecked. Then, if they come back positive and you’d like to run an income verification, follow these steps:

In your Rentec Direct account:

1. Click the Reports tab

2. Click the Screening Reports button

3. Find them on the list and click on their name to run more reports.

4. MOST IMPORTANT: Remember to click the “Choose Products Individually” link at the top of the page to find the ala cart options. If you order from the bundle page, it will charge you again for the whole bundle so be sure to by-pass that but clicking the link at the top of the page.

This Setting Up Tenant Screening Video shows the link for ordering individual reports and is highlighted with a red box. I’ve added it here starting at the 8 minute mark that relates to helping you find that link. Of course, if you need any additional help, please feel free to reach out to your Success Team who are ready to lend a hand.

Hi quick question on this service! If the tenant has more than one bank account that have deposited income that needs to be verified would we need to run a separate report for each account and pay the $ fee for each one?

I’ve also noticed the “Ala Cart” option is $9.50 while the add on is $5? If we run a screening report first and come back later for the income verification is there a way to get the $5 price still? Same question if they have multiple bank accounts, would it be $5 for the first one then we’d have to pay $9.50 for each additional account?

Thanks for the help!

Hi Ryan,

Great questions; the $5 charge is specifically for add-ons when you are submitting a bundle or package of reports. There is only an option of adding 1 bank account at the time at the reduced amount. If you were to submit the bundle then later add an income verification, the a la cart pricing will be in place. Hope this helps add some clarity! If you have any more questions, let us know and someone from our success team can reach out, or you are welcome to call or email success@rentecdirect.com and they will be happy to help!