Rent is often the biggest expense of a renter’s budget. And renters can now use these on time payments to improve their credit score, thanks to a new integration between Rentec Direct and RentReporters. This new feature gives Rentec Direct landlords and property managers an easy way to improve their tenants’ credit and enhance their renter relationships.

Rent is often the biggest expense of a renter’s budget. And renters can now use these on time payments to improve their credit score, thanks to a new integration between Rentec Direct and RentReporters. This new feature gives Rentec Direct landlords and property managers an easy way to improve their tenants’ credit and enhance their renter relationships.

Rentec Direct and RentReporters

Rentec Direct is now fully integrated with RentReporters, allowing you to automatically report your residents’ rent payments to 2 of the major credit bureaus. This new feature will help your tenants improve their credit score by an average of 40 points.

How does the Rentec Direct and RentReporter integration work?

Your tenants simply sign up for RentReporters in their Tenant Portal, and then Rentec Direct will automatically report up to 2 years of rent payment history from your account. Rentec Direct will automatically provide RentReporters with ongoing payment data so there is no work for the property manager.

Prior to this integration, if your tenant wanted to report their rent payments to credit bureaus, you would have had to work directly with RentReporters and manually report rent payment details each month. Now the process is automatic and streamlined for you.

Get started with RentReporters: Two Simple Steps

- Activate your RentReporters setting in your Rentec Direct Account

- Tell your tenants you can by help improve their credit score, since they are a RentReporters landlord or property manager

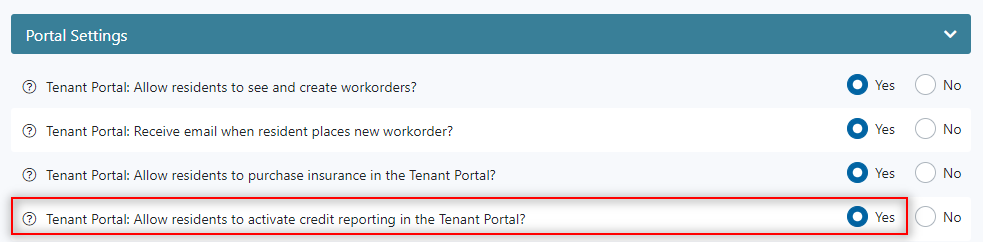

Step 1 – Activate RentReporters reporting option in your Rentec Direct Account

In your Rentec Direct account:

- Click Settings.

- Click on Program Defaults.

- Under Portal Settings find the ‘Tenant Portal: Allow tenants to report rent in the Tenant Portal‘ option and select YES.

- Click Save Changes to enable this feature.

If your tenant signs up for RentReporters through the Tenant Portal, Rentec Direct will automatically report their rent payments, including up to 24 months of rent payment history, to the credit bureaus. It’s that simple!

This feature is free for Rentec Direct landlords and property managers. Your tenants will be charged a monthly subscription fee by RentReporters for their service when they sign up for an account.

Step 2 – Tell your Tenants about Credit Boosting Options in the Tenant Portal

Let your residents know you are connected with RentReporters and they can sign up in their Tenant Portal to start improving their credit score in as little as 10 days.

Your tenants can sign up for RentReporters in the Tenant Portal. Once they activate their RentReporters account, Rentec Direct will automatically report up to 2 years of rent payment history.

You can share the following flyer with your tenants or check out the Tenant Resources in your Rentec Direct Knowledge Base for more marketing materials to help your renters improve their credit scores.

Downloadable Flyer: Improve Your Credit Score With RentReporters

FAQ About RentReporters for Your Renters

The following information pertains to your renters and are details you can share directly with them.

What does RentReporters do?

RentReporters will add up to 2 years of rent payment history to your credit report and then continue to report your ongoing monthly payments to help strengthen your credit.

Will it increase your credit score?

Reporting rent generally strengthens your credit score and thickens your credit profile.

What if you don’t have a credit score?

If you don’t have a credit score, expect that to change. Most customers earn a score of greater than 625 after reporting their rent history.

How much does it cost?

$9.95 a month and the signup fee is waived (a $94.95 savings!!)

Note: Rentec Direct landlords and property managers are not charged for this feature.

How do I sign up?

Log in to your Tenant Portal and follow the prompts. We’ve partnered with Rentec Direct to make things as simple as possible!

How long does it take?

Once you enroll, expect your credit report to be updated in as little as 10 days.

Is there a satisfaction guarantee?

Yes, if you aren’t satisfied for any reason you can cancel anytime. There are no contracts.

I own rental properties and my property manager uses Rentec Direct software. Do you offer them a way to report to the credit bureaus delinquent rent. And if you do not why not. Tenant debt is a major problem and it would be very helpful if we could report delinquent rent. You have set it up for the tenants now how about the landlords.

Thanks for your question, Donald. We love hearing direct feedback from hard working landlords and end-users of the software like you. Unfortunately, we don’t have that option available as yet — but I will certainly pass on your comments to the development department for consideration. Thanks again for taking time out of your busy day to comment and wishing you all the best continued success!

Thanks again, Donald for the feedback. I’ve had a chance to ask some questions and get a little insight and wanted to follow-up to share what I’ve learned. Reporting delinquent rent payments is a little tricky and must always adhere to Federal Fair Credit Reporting rules and regulations. The only way to automatically report rent payment data (both good and bad) to the credit bureaus is to have the tenant opt in. Using a service like RentReporters can actually help increase on time tenant rent payments, because a tenant who signs up for the service will not want poor rent payment details to be sent to the credit bureaus. The result is a tenant who will prioritize on time payments to improve their credit. Another option is to report unpaid rent and tenant debts to a collection service, like Rent Recovery Service mentioned below, who can pursue collections on a tenant and can then legally report the debt as a collection agency to the credit bureaus.

You can also use https://www.rentrecoveryservice.com/#features to report. That is who our brokerage uses, they are also a collection agency, if you choose to go that route.

Thanks for that suggestion, Christopher! I love it when the property management community comes together to share tips among friends.

I am checking for a way to turn over tenant that have moved and owe thousands of dollars not particularly monthly. Well just so happen I received an email from Mrlandlord.com with information on this very subject. They have a form that you fill out and you are charged a fee of 12.95 for each customer the turn in. I don’t remember which ones but the repot only goes to two of the major credit bureaus. I think you also have to send a letter to the tenant informing them what you are doing. And of course if you us a collection agency they turn the tenant over also.

how is the $95 waived? who waives it or who provides the promo code for it to be waived?

Thanks for your question. After a landlord has followed the instructions in the article, because of the integration between Rentec Direct and RentReporters, when a tenant enrolls using the Tenant Portal provided by their landlord no promo code is necessary. They will only be charged the monthly fee.