Finding a qualified and reliable tenant should be a primary focus for a landlord or property manager, and ensuring that this tenant will be found through a legal and aboveboard process is critical to your success.

The best way to find your dream tenant while avoiding discrimination lawsuits is to have a full awareness of Fair Housing Laws (as well as state and local laws) and create a set of written screening criteria that you can equally apply to all applicants. Developing your screening criteria doesn’t have to be challenging. Following a basic tenant screening criteria checklist will ensure that your written screening criteria easily points you to the most qualified and reliable future tenant.

Written screening criteria sets forth minimum, objective tenant qualifications that will benefit a landlord in two ways:

- It streamlines the screening process. If any applicants do not meet your minimum tenant screening criteria you can reject them before spending time calling references and conducting a background check.

- It reduces the likelihood that a discrimination claim because it takes a landlord’s or property manager’s personal, subjective opinion out of the equation.

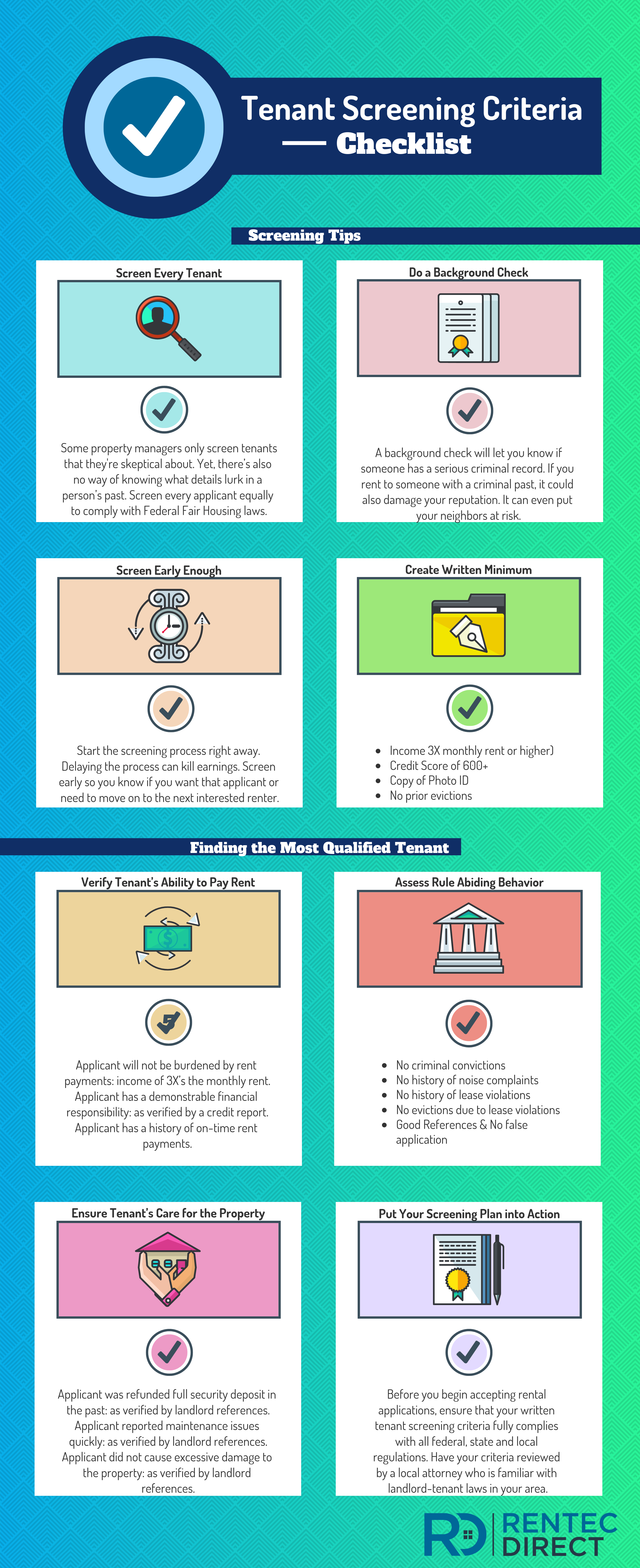

This infographic gives a quick rundown of everything you need to know for your tenant screening criteria checklist:

Screen Every Tenant

Some property managers only screen tenants that they’re skeptical about. Yet, there’s also no way of knowing what details lurk in a person’s past. Use a tenant screening report and screen every applicant equally to comply with Federal Fair Housing laws and to ensure that the tenant you select isn’t hiding a disqualifying issue. Judging a book by its cover–or an applicant by their presentability–can land you in legal hot water now or a difficult eviction process down the road.

Do a Background Check

A background check will let you know if someone has a serious criminal record. If you rent to someone with a criminal past, it could also damage your reputation. It can even put your neighbors at risk.

Screen Early Enough

Start the screening process right away. Delaying the process can kill earnings. Screen early so you know if you want that applicant or need to move on to the next interested renter.

Create Written Minimum

- Income 3X monthly rent or higher)

- Credit Score of 600+

- Copy of Photo ID

- No prior evictions

Verify Tenant’s Ability to Pay Rent

The applicant will not be burdened by rent payments: income of 3X’s the monthly rent.

Applicant has a demonstrable financial responsibility: as verified by a credit report.

Applicant has a history of on-time rent payments.

Assess Rule Abiding Behavior

- No criminal convictions

- No history of noise complaints

- No history of lease violations

- No evictions due to lease violations

- Good References & No false application

Ensure Tenant’s Care for the Property

There are some easy objective ways to predict how likely a tenant is to

- The applicant was refunded full security deposit in the past: as verified by landlord references.

- Applicant reported maintenance issues quickly: as verified by landlord references.

- Applicant did not cause excessive damage to the property: as verified by landlord references.

Put Your Screening Plan into Action

Before you begin accepting rental applications, ensure that your written tenant screening criteria fully complies with all federal, state and local regulations. Have your criteria reviewed by a local attorney who is familiar with landlord-tenant laws in your area.

Remember, establishing your screening criteria before accepting applications is vital to ensure that you are selecting the best possible tenant to fill your vacancies. Screening criteria can help you refrain from making spur of the moment or subjective decisions, and can protect you from baseless claims that you harbor discriminatory opinions. Following the tenant screening criteria checklist will ensure that you create an objective and legal basis for evaluating all applicants, which will serve to protect you and your property long-term.

This is great! Thanks Brentnie, I can’t overemphasize the need to have that written list. Out here in the People’s Republic of CA, not only do you have the professional game players but there are stings by the state as well to see how you do – winging is not an option. Nor is going out of order. I’m amazed by managers who still say, we gather up a bunch and let you decide. Good luck with that. The game players know all this and will try to trip you up with their same sex spouse, their alleged kids, their service dogs or handicap needs to try to catch you off guard for discrimination, or to force you into thinking that you HAVE to rent to them regardless. Know the laws and call them on it, or get a pro.