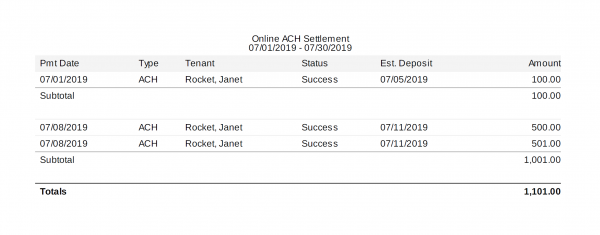

Does this scenario sound familiar? You have a deposit into your operating account from Forte for $1,001 dollars, but being as weekends and countless bank holidays can muck up the actual bank deposit date that deposit might have been from yesterday, or four days ago. All you really want to do is make sure the deposit into your account matches your records, and it can be complicated, especially if you have multiple merchant accounts. You really just need to know what made up that merchant deposit.

We have some fantastic new reports that are going to make life so much easier if you are accepting online tenant payments. We’ve connected deeper with Forte’s data and can now provide you separate ACH and Credit Card settlement reports, subtotaled by day of deposit. These reports line up exactly with what your bank deposits from Forte look like so it takes the, sometimes tedious, guesswork out of matching those deposits to your rental income. With our recent integration to the cash payment network, we are able to offer the same settlement report for CASH deposits as well.

If you are using Rentec Pro or PM you already have access to these new reports. We covertly snuck them into the system earlier today before publishing this announcement. Just navigate over to Financial Reports, Online Payments, and choose any of the new settlement reports. You can fine-tune the data in the reports by selecting a date range, property, account, or owner in the left column.

The deposit date estimates are designed to accommodate most Tier 1 banks that do deposits the quickest; however, if you use a smaller credit union or Tier 2 bank or have upgraded to same day funding from Forte, you might need to fine-tune your settlement days. You can do this by navigating to Settings, General Settings, Advanced Settings and adjust the Settlement days options at the bottom of the page.

Thank you! Thank you! Thank you!

This is fantastic! Thank you.

Glad to hear you’ll find it helpful, Peter!

This is wonderful. The last couple of months I’ve used Excel to help speed up my process of reconciliation because I was spending too much time trying to figure it out. I’m so happy there is a report now.

Yay! So glad you will save all that time. Thanks for your kind feedback.