The global COVID-19 pandemic has touched everyone’s lives, causing nearly every industry to adapt to a new normal. The rental industry is no exception and the industry is creating new ways to implement safety measures and meet the needs of renters.

As a response to the nation’s climbing unemployment rate, several states implemented an eviction moratorium at the onset of the pandemic to protect renters unable to pay their monthly rent. Most recently, the CDC issued a federal eviction moratorium through the end of 2020.

Despite the moratorium on evictions, however, rent is still due. And the majority of renters are still making full or parietal rent payments.

Rent Payment Trends During the 2020 Pandemic

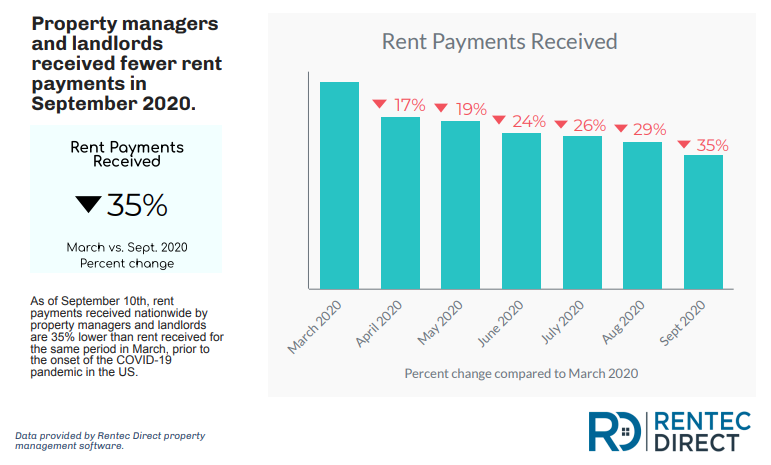

Rentec Direct has been tracking rent payment data on over 620,000 rental units since March 2020 to further understand the impact of COVID-19 on rent payments and rent payment methods. By comparing the first week of each month to the same period in March 2002, when most state shut down orders occurred we can determine the impact of the pandemic on rent payments.

See the Rental Trends Report: Impact of COVID-19 on Rent Payments and Rent Payment Methods | September 2020

Rent Payments Dropped in September 2020

Data from September 2020 indicates that renters are slightly more financially burdened than previous months, as rent payments received decreased by 6% from August 2020 to September 2020.

Online Rent Payment Options Increase Likelihood of Paying Rent

Of tenants who pay rent electronically, nationwide rent payments in September are 1% higher than online rent payments received for the same period in March. When compared to the 35% decrease in total rent received for September 2020, it is clear, online rent payment options increase the likelihood of paying rent.

See the Rental Trends Report: Impact of COVID-19 on Rent Payments and Rent Payment Methods | September 2020

The Future of the Rental Industry

While some people are optimistic that the economy and job growth will improve, the recent increase in national COVID-19 cases could threaten American’s economic future.

The National Bureau of Economic Research (NBER) determined that the US has been in a recession since February. Unlike previous recessions tied to economic weakness, the current recession is due to the impact of COVID-19 specifically.

Much like the behavior of a virus, the impact of the pandemic on the market continues to spread throughout the different real estate market sectors and has severely affected the housing, and more specifically the rental housing market in relation to those subjected to under and unemployment.

With the decline in rent payments received, the lost revenue, and the costs associated with evictions and tenant turnover, landlords are facing challenges.

Landlords and property owners benefit when policies are made where mortgages are protected and renters receive relief aid to cover their rental responsibilities.

The coming months will reveal how renters will handle their monthly rent payments and other expenses. And what the response will be from landlords, property managers, and real estate investors, as they continue to navigate these uncertain times.