Reduce end-of-year stress with easy to manage tax reporting functions and e-filing services in your property management software.

As much as we want this time of year of to be filled with nothing but candy canes and cocoa, the real life Grinch of the holiday season means the end-of year tax season will be here as soon as you wake up from your tryptophan induced food coma. For property managers and landlords, tax season stress can be alleviated by preparing early and simplifying tasks with online services. Using the tax features built directly into your property management software you can help you stay organized and prepared when it comes time to file your 1099-MISC forms for 2014.

Rentec Direct customers are able to electronically file 1099 forms for vendors and owners directly through the software. There is no need to re-enter data or pay your tax advisor to file these forms for you, because the software makes it a very simple and cost effective process for you. As a property manager or landlord, you are required to issue 1099s to any service provider who receives $600 or more for work relating to the rental property.

Whether you own or manage rental properties, we recommend you start managing the following tasks now, so you are prepared come January.

- Verify you have the correct federal tax ID number for your vendors and owners. For individuals, this is their social security number (SSN), and for businesses this is their employer identification number (EIN). Request a W-9 form from any vendor or owner if you don’t already have one on file.

- Confirm that you have an accurate mailing address for each owner and vendor. You will need to send each vendor and owner a copy of their 1099 form, which they use for filing their personal or corporate tax return.

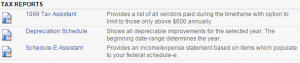

- Check your numbers. It’s never too early to make sure your numbers match your records. The 1099 Tax Assistant Report in Rentec’s software appropriately shows incomes and expenses per property. This is the same data that will be used for populating the e-filing system in the program. The 1099 Tax Assistant Report and the 1099 e-filing feature will utilize all the owner distributions and vendor payments entered throughout the year, so there’s no need for double entry.

Even if you don’t use Rentec’s automated e-file features, the 1099 Tax Assistant Report is a vital report to give your CPA or use if you manually filling your 1099 returns. It provides the necessary information to quickly and accurately complete the tax forms.

Remember to revisit our blog often over the next couple of months, to learn more helpful tips about how to prepare and file your taxes specifically for property managers and landlords. Bookmark this page, subscribe to the blog below or like us on Facebook for easy access to the latest information from Rentec Direct.

Great tips! It’s always great to get started quickly on the taxes before the work starts to pile on.

Thanks Jack, I am glad you found the post helpful!