The CARES Act came to an end administratively July 26th and Congress and Washington are in negotiations this week to establish new relief measures while the pandemic continues to impact the economy at large.

Intertwined and intersecting, the impact of the virus on the economy is creating unprecedented proportions of unemployment, current and up-and-coming evictions, and foreclosures. In turn, manifesting changes in real estate indices, the rental market, and overall housing concerns.

US Economy and the Real Estate Market

The National Bureau of Economic Research (NBER) determined that the US has been in a recession since February. Unlike previous recessions tied to economic weakness, the current recession is due to the impact of COVID-19 specifically.

Much like the behavior of a virus, the impact of the pandemic on the market continues to spread throughout the different real estate market sectors and has severely affected the housing, and more specifically the rental housing market in relation to those subjected to under and unemployment.

Unemployment Impact on the Housing Market

The US, a mere seven days after the World Health Organization (WHO) declared the situation a pandemic, signed the Families First Coronavirus Response Act (FFCRA) on March 18th. Nine days later the Federal Cares Act was signed into law and subsequently the Pandemic Unemployment Assistance (PUA).

As of the end of June, between the new and continued unemployment claims and the PUA claims (which include independent contractors and gig workers not normally eligible for compensation) almost 33 million Americans were receiving some type of aid.

To compound the issue, according to the Tax Foundation, 21 of the US State unemployment insurance trust funds were already underfunded by the end of June to adequately weather this recession.

Employment concerns and changes in unemployment benefits are leaving a huge population of Americans vulnerable to evictions and foreclosures.

SOURCE: aspeninstitute.org

Real Estate Home Sale Prices and Foreclosures

For those with mortgages backed by the federal government, mortgage forbearance and the moratorium on foreclosures is keeping the real estate market afloat for now.

However, the tide may turn as mortgage delinquency rates rise and the foreclosure moratorium expires at the end of this month. Some believe a minor housing crash may occur if additional policies aren’t drafted. The saving grace being the forbearance option will continue for up to a year, meaning it won’t be until 2021 for the complete picture to come into focus on homeownership.

This unprecedented time, remote work options provide the opportunity to move out of high-density metropolitan areas. Many homeowners are migrating to areas with a lower cost of living, and to be closer to family, and/or be closer to leisure and lifestyle options.

Other homeowners struggling with mortgage payments or anxious about the stability of employment and/or finances are also on-the-move in search of employment, better opportunities, and/or more affordable housing options.

At the early stages of the pandemic, home sales slowed. But today, there seems to be a flurry of home purchase activity believed to be in great part due to the lowered interest rates and remote work options.

At the current pace, there is a 4 month supply of unsold inventory and the pent up buyer demand has yet to be satisfied. Not only have home sales continued to rise, but prices also continue to remain steady and even rise in more desirable areas.

But the trend may not last past 2020 where predicted home price growth will flatten. Many are anticipating a slump in prices by spring 2021 due to the impact of the recession. Other experts are holding out hope that prices will not see a drop until after the federal policies that are stabilizing the housing market have ended and forbearance is set to expire next summer.

Whether sooner or summer next, investors will have an opportunity to build on their rental portfolio in the near future if these predictions hold true.

Economist Hugh F. Kelly states, “A drop-off in business confidence is an indicator of an uncertain future.”

Rental Market and Tenants Ability to Pay

Renters have been hit the hardest and continue to struggle to make full rent payments. Freddie Mac Multifamily predicts vacancy rates will continue to rise as rent prices fall through the end of the year at a rate dependant on the economy’s recovery.

Rentec Direct has found a decline in rental payments month-over-month since March 2020 when they began a study on the payment behavior of renters in over 620,000 rental units. The greatest decline to-date was in July where rent payments received were 26% lower than those in March.

The August report is due to be published next week but anticipated to show a continued downward trend. The most current report is available here: Impact of COVID-19 on Rent Payments and Rent Payment Methods | July 2020

Evictions

National Public Radio (NPR) predicts a ‘Tsunami of Evictions’ on the horizon as unemployment benefits wane and eviction moratoriums lift. In some areas and for some rental scenarios that the moratorium didn’t protect, evictions have spiked to overwhelming levels. One example was in Wisconsin which showed a 24% increase in eviction filings in June.

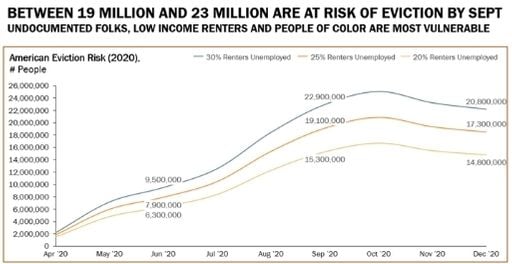

By mid-June, over 44 million Americans on unemployment and as many as 23 million were at risk of eviction in September and the number is rising.

Unfortunately, there has been confusion about the CARES Act and federal and state moratoriums leaving many to believe that all evictions have been banned. With the many nuances and without proper research some landlords have been participating in illegal evictions or have not processed an eviction when it was in their privy to do so.

An eviction process can take months when courts are operating at normal capacity. With courts overwhelmed it may take much longer with renters taking advantage of the process by squatting.

Eviction data such as state rankings and this online interactive tool offered by Eviction Lab, is available here: Eviction Lab Data Map

Future Predictions and Relief

Recently, according to the Housing Market Recovery Index Highlights from Realtor.com, the US housing market has returned to 2020 growth levels which is a start to recession recovery.

The pandemic and recession may spark creative solutions such as conversion projects and drive long-term or vacation rentals to begin offering student and corporate housing.

With the decline in rent payments received, the lost revenue, and the costs associated with evictions and tenant turnover, landlords are facing great difficulty during this ongoing storm.

Landlords and property owners benefit when policies are made where mortgages are protected and renters receive relief aid to cover their rental responsibilities. In that, this week’s negotiations in Washington holds the key to the outcome of the future housing market.