The rent roll report is one of the best and most versatile (yet under-utilized) financial reports available to anyone in the rental real estate industry. This often overlooked gem holds benefits for lenders, investors, landlords, and property managers alike.

Let’s dive into this useful financial report to find out what it is and why it’s so important for your property management business.

What is a Rent Roll Report

A rent roll report shows key information in one easy to read document about the real time gross income from your rental properties. This snapshot in time is date-bound, meaning the day you enter to pull the report, the data reflects those totals for that day.

Types of information you’ll find on a rent roll depends on your property management software or spreadsheets but likely will give you a quick overview of:

- What the tenant was charged

- How much the tenant paid that month

- The tenants current balance (whether they are delinquent, paid in full, or paid in advance)

- Security deposits held per tenant

- The market value of the unit or property (also known as the market rent)

- And other important information such as the tenant contact information and property description and details.

Again, depending on your landlord software, this report can often be pulled by property such as an apartment complex, by specific date, and by property ownership.

A rent roll report is specific to providing information about income and helps for analyzing income activity and market behavior so you will find that it does not track expenses, mortgage, payroll, taxes, etc. For granular details of specific ledger entries or category totals you’d turn to reports such as account or category ledger reports.

If you’ve ever asked, “How much should I charge for rent?” then a rent roll report is a perfect tool to help with that answer as well as help identify opportunities for cash flow.

Tip: Pull and save monthly rent roll reports and you’ll be able to track trends in income received month over month and year over year.

Rent roll reports give a birds eye view of the income and income potential of rental assets you own or manage with key information to make informed rental business decisions about lease renewals, rent increases, and managing delinquent tenant concerns. Additionally, a rent roll provides investors, sellers, and lenders information when negotiating the purchase, sell, or financing of a rental asset.

Rent Roll Reports:

1. Benefits Landlords and Property Managers

A major component of being a landlord is in the data-entry of information. Keeping data up-to-date and accurate is not only helpful for audits and tax purposes, but can be a powerful tool for analysis and decision making.

How is a rent roll useful to a property manager or landlord? With a rent roll report you can:

- Quickly see how soon leases are due to keep ahead of that lease renewal process

- Know at a glance which tenant is delinquent on any specific day

- Know a tenants current balance and how much they have paid that month

- Have all tenants important contact information in one place so you can reach them regarding delinquencies or other important matters.

- See the security deposit amounts held

- Follow fluctuations in market rent

- See trends in cash flow

- And much more!

In addition to the specific tenant totals, the report also shows the category totals which provide the data points for analysis to best predict future profitability or areas that need improvement such as rent increases, deposit increases, and lease renewals.

Tip: Although similar to a delinquency report, a rent roll can provide you information on all tenants (not just those with balances due).

2. Benefit Property Management Companies

Property management companies use the rent roll in similar ways as private landlords but a rental management company might also take advantage of a rent roll report to dig deeper into the data at an owner level so they can communicate with owners about the status of their portfolios.

Although landlords and property managers use market rent information and other metrics to follow fluctuations and make predictions on a per property or portfolio level, property management companies analyze the rent roll financial report for trends to help increase the profitability of their clients (owners) assets which in turn benefits the property management company’s bottom line.

3. Help Investors Make Purchase Decisions

Real estate investors rely on the rent roll reports as part of their due diligence to get an accurate picture of the potential of rental property prior to purchase.

Having move-in dates and lease expiration dates allow investors to see how seasoned the tenancy (how long each tenant stays in a property – aka tenant turnover).

Knowing when leases are due for renewal helps investors know when they could expect to be able to increase rental rates or decided if they would renew or let the lease expire to make way for new tenants at the current market rents.

All-in-all, it helps the investor (along with other documentation) determine the value of the property or portfolio by comparing the vacancy rates and rent amounts with market averages.

It’s not just the buyer who would be interested in what a rent roll report details, sellers can use the report to negotiate the best selling price based on that information.

4. Provide information to agencies and institutions

Investors, property management companies, landlords and property managers can all take advantage of a rent roll report to understand better the true value of an income producing property. But other groups may have an interest in that information as well such as:

- Government and non-profit agencies

- Property appraisers

- Lenders and financial institutions

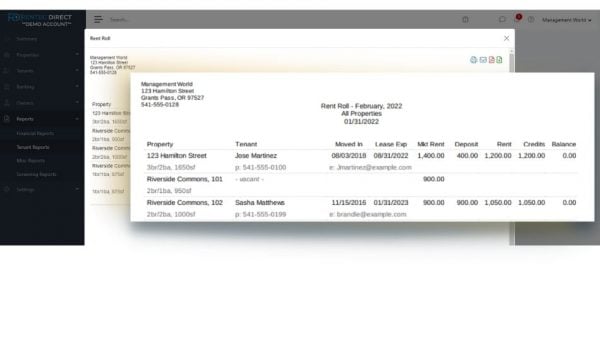

What does a rent roll look like?

Depending on your customized options, it could include:

Property address is the physical address that is listed in tax forms, documents, and lease agreements.

Property information include the number of bedrooms, bathrooms, and square footage and provides a quick comparison against market rents and other units in the portfolio and market rents when deciding on rent increases.

Vacant units will be listed which help investors understand potential rent income and helps landlords stay on-top of filling vacancies.

Tenant move-in dates can highlight long term tenants vs multiple short term tenant turnover issues.

Lease expiration dates allow investors to see potential for rental increases or market value options and help landlords know when leases are up for renewal.

Rent amount charged lets the reader know what was expected versus the amount received.

Tenant ledger balance gives a snapshot if the account is delinquent, paid-in-full current, or paid in advance.

Market rent is an important indicator of income potential.

Security deposits held (which is often an optional data point) can help lenders, investors, and financial institutions make decisions.

Payments received in current month notes how much the tenant has paid towards the rent charged.

Tenant contact info is an important element so you can reach out to the tenant quickly.

Other portfolio or multi-unit property information such as:

- Market rent totals

- Security deposit held totals

- Rent charged totals

- Payment received totals (credits)

- and tenant balance totals

Commercial Rent Roll vs. Residential Rent Roll

Residential rent roll reports often have the number of bedrooms and bathrooms as well as square footage listed for comparison when looking at market rents and current rent charges.

Commercial rent roll reports will list the square footage and investors and lenders look at longer lease terms.

Both commercial and residential properties can be included on the same report.

Where can you find a rent roll template?

Using accounting software alone won’t provide property management and rental industry standard reports like a rent roll. That’s why many turn to old school spreadsheets, download a rent roll excel template, or search for other online resources. But those options require manual entry (which is likely doing twice the work if you already enter information somewhere else) and cumbersome access and storage. Not to mention, may lack the flexibility or customization your business requires.

The smart move is to use a property management software solution that provides a customizable rent roll report. Not only will you have an enhanced report you can pull, save, send, and share but also have quick access to all the other important tax and financial reports and documents you’ll need to make the best business decisions.

If you don’t have access to an enhanced rent roll report in your property management software it could be time to find a landlord software that provides one so you can start taking advantage of the great insights and information available.