A new decade-long study reveals rapid adoption of online rent payments and major reductions in late fees for renters who pay digitally, according to a report from Rentec Direct property management software.

GRANTS PASS, Ore., December 10, 2025 — Full Press Release Available on PRWEB

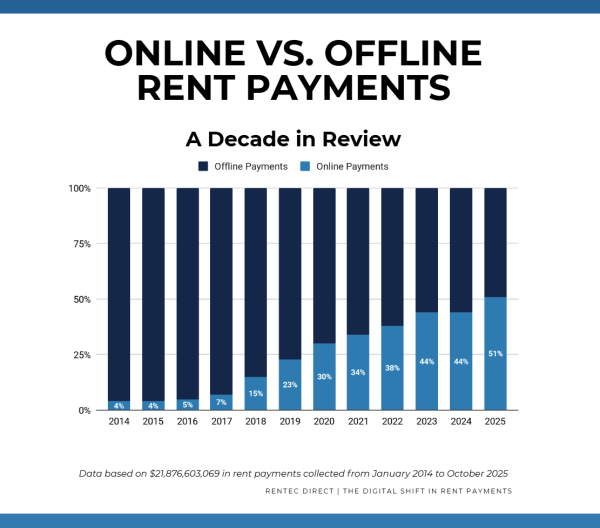

A new Rentec Direct analysis of more than 21.9 billion dollars in rent payments shows a historic milestone. For the first time, the majority of rent payments in the United States are made online. The ten-year study reveals that digital rent payments have surged from just 4 percent in 2014 to 51 percent in 2025.

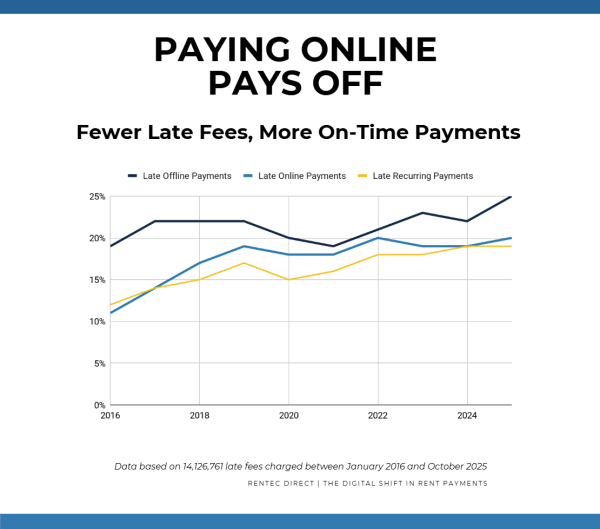

The Digital Shift in Rent Payments Report confirms a major transformation in how renters pay rent and how landlords manage collections. The findings highlight significant financial benefits for both parties, including reduced late payments, improved cash flow, and a more convenient and reliable payment experience. Renters who paid rent by cash or check were 23 percent more likely to pay late compared to those using online methods.

As renters adopt digital tools, property managers and landlords are moving toward platforms that prioritize automation, streamlined bookkeeping, and better tenant communication. The result is a more predictable and efficient rental ecosystem.

Key insights from the report:

- Digital payments take the lead: Online rent payments increased more than tenfold over the past decade, becoming the majority payment method in 2025.

- Late fees drop with digital payments: Tenants paying online, especially with recurring payments, consistently avoid late fees at higher rates than offline payers.

- Pandemic accelerated digital adoption: Online payments rose from 23 percent in 2019 to 38 percent by the end of 2022 as both renters and landlords moved away from in-person or paper-based payments.

- Efficiency wins: Digital payments save landlords time, reduce manual workload, and support better financial forecasting.

“The data confirms what we have seen across the industry. Digital rent payments are not just more convenient. They fundamentally improve the rental experience for everyone,” said Nathan Miller, Founder and CEO of Rentec Direct. “Automation and real-time systems allow landlords and property managers to spend less time reconciling payments and more time supporting tenants and expanding their businesses. This shift represents the future of property management.”

Landlords participating in the study echoed the impact of digital tools on their workflows. John S., a Rentec Direct landlord, said: “Collecting rent online saves us hours every month. When tenants pay directly through verified financial accounts, the funds go straight into our bank, which streamlines our entire rent cycle and eliminates unnecessary manual steps.”

The report also includes perspectives from property managers who continue to use checks for their own record keeping practices, reinforcing the importance of offering flexible payment options while embracing tools that increase efficiency.

You can access the full report and more rental industry research here: Digital Shift in Rent Payments Report

Methodology

Rentec Direct analyzed aggregated, anonymized data from its property management software platform between 2014 and 2025. The dataset includes rent payment and late fee activity from more than 1.2 million unique tenants, representing $21.9 billion in processed rent payments. The data is intended to illustrate trends and insights in rent payment behavior and may not be fully representative of the industry as a whole.