The State of Rent: Housing Affordability Trends Across the U.S.

Over the past decade, the U.S. rental market has undergone significant shifts, shaped by economic turbulence, demographic trends, and evolving policy decisions. Factors like pandemic-driven migration patterns, labor market transformations, fluctuating inflation and interest rates, and housing supply challenges have all influenced rent prices nationwide.

The COVID-19 pandemic triggered a wave of disruption when record-low mortgage rates fueled a surge in home buying, temporarily softening rental demand. Post-pandemic, as interest rates climbed and inflation persisted, housing affordability declined and demand for rentals increased, driving rent prices higher in many regions.

Some states have seen dramatic rent hikes, further straining affordability for tenants. Others have started experiencing stabilization or even price declines, influenced by new housing inventory and population shifts.

This report breaks down the changing rental market landscape in the U.S., examining where rents have risen the most, where they have remained stable, and what these patterns mean for national housing affordability. By analyzing data based on rent payments collected by landlords and property managers nationwide from 2019 to 2024, our team of rental industry experts provides insights into the trends shaping the rental market in 2025.

May is National Affordable Housing Month

Affordable Housing Month serves as an annual reminder of the importance of accessible, secure housing and is a time to

explore the challenges and opportunities in housing affordability. With over 100 million renters in the U.S., Rentec

Direct is committed to sharing data and insights that empower tenants, landlords, property managers, and real estate

investors to make more informed decisions and navigate an evolving rental market.

Methodology: Rent Paid vs. Advertised Rent

Data in this report reflects rent payments made by tenants instead of advertised rent prices for vacant units, which

offers a more accurate snapshot of what tenants are actually paying across the country. Actual rent payments are

often lower than advertised prices.

Rentec Direct collected aggregated anonymous rent payment data from users of its property management software

platform. This data represents information from 301,524 tenants nationwide. Averages are based on 374,475 unique

lease agreements.

Lease agreements include single-family and multi-family properties, individual rooms rented and mobile homes. Rent payments

on commercial properties and rent values above $20,000 are not included in this dataset to ensure a more accurate representation

of typical rent trends.

Data is intended to show trends only and may not be a perfectly representative sample of the industry as a whole.

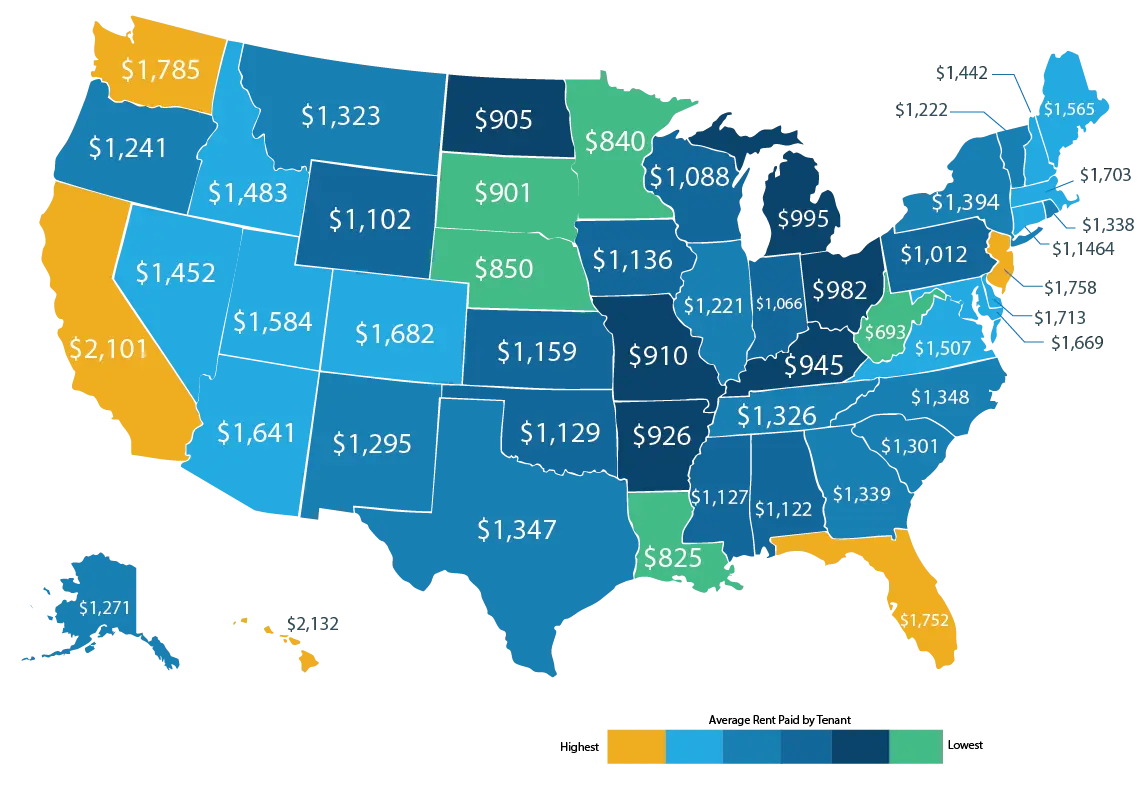

How Much Are Tenants Really Paying in Rent? A State-by-State Breakdown

- The national average monthly rent paid by tenants in 2024 was $1,302, reflecting a 31% increase over the past five years.

- The most significant year-over-year increase was from 2021 to 2022 when the national average rent paid jumped by 8%. This could be due to landlords offering more flexibility with rent payments during the pandemic, including larger discounts or allowing late payments without penalty.

- The Pacific region appears to dominate as the most expensive rental market, while the South and Midwest offer the most affordable options.

- Hawaii ($2,132)

- California ($2,101)

- Washington ($1,785)

- New Jersey ($1,758)

- Florida ($1,752)

- West Virginia ($693)

- Louisiana ($825)

- Minnesota ($840)

- Nebraska ($850)

- South Dakota ($901)

Regional Rent Trends: Where Rents are Rising, Falling, or Stabilizing

These states experienced the most significant increases in the average rent paid by tenants over the past five years.

Arizona

saw a 84% increase

Tennessee

saw a 67% increase

New Mexico

saw a 65% increase

Georgia

saw a 63% increase

Maryland

saw a 61% increase

Other notable increases include:

- South Carolina (+56%)

- Alaska (+54%)

- Idaho (+54%)

- Montana (+54%)

- Wyoming (+53%)

Insights:

- None of these ten states have rent control at the state level, allowing landlords to raise rents without any caps as long as they comply with local ordinances and notice requirements.

- Arizona has one of the fastest-growing populations in the country—especially among retirees—while also facing a significant housing shortage. This combination is driving up demand. Several large companies have relocated their headquarters to Arizona in recent years, including Dutch Bros, DoorDash, and Comtech, further adding to this pressure.

- Tennessee’s strong economic and job growth, favorable business climate, and low taxes are attracting more people to the state, driving demand for housing and creating greater competition.

- New Mexico has become an attractive alternative for people relocating from high-cost states like California, but housing shortages—particularly in rural parts of the state—remain a major issue. Growth in non-traditional sectors like renewable energy and defense contracting have contributed to job growth and demand for housing.

- A recent construction boom in Georgia added thousands of new units in the metro Atlanta area, but rents are still trending upward as inventory is absorbed. One study suggests that large corporations own a significant portion of the state’s single-family homes, and this concentration of ownership contributes to rising rents.

- Maryland’s proximity to Washington D.C., its strong job market and economic growth, and a significant number of affluent suburbs attract high-income residents, all driving demand for housing in a state with limited land for new construction.

- South Carolina is attracting a large retirement and remote worker population, increasing demand in both urban and rural areas. Similarly, states like Idaho and Montana have become popular relocation and recreation destinations, further intensifying pressure on rental markets.

Minnesota experienced a 34% decrease in the average rent paid by tenants over the past five years.

Minnesota

saw a 34% decrease

Insights:

- Minnesota is undergoing major land use reforms aimed at increasing housing supply and reducing housing costs by promoting diverse housing options. The Minneapolis 2040 plan, implemented in 2020, eliminated single-family zoning in certain areas to allow for higher-density housing development, and the proposed “Yes to Homes” bill suggests easing zoning restrictions, streamlining apartment construction, and increasing availability of accessory dwellings, townhomes, and duplexes.

- Preliminary data shows rising rents in Minnesota in Q1 2025, but averages are still well below levels seen before land use reform legislation introduced in 2020.

These states experienced the smallest changes in the average rent paid by tenants over the past five years, indicating a potential shift toward stabilization. This suggests that while affordability challenges persist in many regions, some states are seeing a slowdown—or even a reversal—of rapid growth in rental prices.

Louisiana

New York

Insights:

- Following the devastation of hurricanes like Katrina and Ida, Louisiana’s rental market experienced significant disruptions and slower economic growth compared to other states. As recovery and reconstruction efforts add new housing, the market is finding more balance, which can lead to stabilization in rent prices. An increase in rental vacancy rates also contributes to stabilization as landlords compete to maintain occupancy and fill vacant units.

- Several municipalities throughout New York have implemented rent control or rent stabilization systems intended to protect tenants from excessive rent increases and evictions. These measures can often positively impact affordability in high-demand areas. The exodus of residents during the pandemic temporarily reduced rental demand, and as the city recovers and demand returns, rent prices are gradually stabilizing.

These states experienced the most dramatic changes in average rent paid by tenants from 2019 to 2022, reflecting the pandemic’s impact on housing demand, affordability, and migration trends:

- California, Florida, and Hawaii also experienced significant rent spikes during the pandemic, driven by shifting migration patterns and increased housing demand as remote work allowed Americans to seek out suburban areas with warmer climates.

- In contrast, Connecticut was one of the only states to see a sharp decline in rent during the early stages of the pandemic (-$181 from 2019 to 2021), followed by a dramatic rebound the next year (+$303 from 2021 to 2022). This is likely a result of residents fleeing densely populated areas like New York City for less expensive, less crowded environments but then returning to urban areas post-pandemic. This volatility underscores how external economic factors and demand shifts can drastically impact rental prices over short periods.

Key Takeaways for Tenants and Landlords

Implications & Advice for Tenants

Rent prices have fluctuated differently across the country—some states saw sharp price increases, while others have started to see signs of stabilization or even decline. Prospective renters should carefully research local market conditions to make informed decisions before committing to a lease. Affordability remains a growing challenge, but tenants may find greater flexibility by considering less expensive suburban or rural areas—though these markets may also bring increased competition. Tenants will find the highest costs, fewest available options, and most intense competition in regions with limited new housing development.

- Prioritize a positive landlord-tenant relationship — Landlords are more likely to offer discounts or incentives for lease renewals to great tenants. Turnover can be costly, so building a strong relationship with your landlord and being a reliable, rule-abiding tenant can increase the likelihood of your landlord working with you on favorable terms.

- Report maintenance issues immediately — Rent increases happen as the cost of property upkeep increases. Renters who address maintenance issues early and before they lead to extensive damages can minimize the overall cost burden on landlords to maintain the property.

- Negotiate your lease terms — Tenants always have the option to negotiate the terms of their lease agreement—for reduced rent, shorter or longer leases, or added perks like parking, updated appliances or pet accommodations. Before signing any lease, take extra time to carefully review all terms and conditions, especially those related to rent increases, renewal clauses and additional fees.

Implications & Advice for Landlords

Landlords in high-demand areas may experience greater profitability but should prioritize tenant retention strategies to minimize turnover and avoid vacancies. In areas where rent prices are stabilizing or declining, landlords may need to adapt by offering more competitive pricing or added amenities to attract and retain tenants. Landlords should expect to continue navigating increased maintenance and operating costs due to inflation and supply chain disruptions, making flexibility in pricing adjustments or other incentives essential to stay competitive.

- Small but regular rent increases are key — Raising rents in small increments year over year can help meet inflation demands over time while improving affordability for existing tenants.

- Incentivize long-term tenants — Turnover and vacancies will have the biggest impact on your bottom line, and these vacancy periods can be longer in a challenging market for renters. Consider offering incentives like discounted rent, free parking, or amenity upgrades for tenants who commit to longer lease terms.

- Stay informed on local laws and regulations — Stay up-to-date on any local or statewide regulations covering rent control, evictions, and other tenant rights to make sure your practices stay compliant. Familiarize yourself with the differences between rent control and rent stabilization, and be transparent about any rent increases at your properties with clear and advance notice. Being upfront about the need for rent increases can often help tenants better understand and accept the change.

Rental Market Trends to Watch in 2025

- Slower rent growth: Preliminary data from 2025 indicates that average rents continue to trend upward, but at a slower pace than the past five years. Factors like higher interest rates, inflation, and tighter consumer budgets could contribute to slower rent growth.

- Local market variations: Some states, like North Dakota and New Hampshire, have seen declines in average rent paid in Q1, though it’s still too early to determine whether these trends will stabilize or rise as the year progresses. These declines may be driven by unique regional factors and may not be representative of broader national trends, or they may signal market corrections after rapid growth in recent years.

- High demand in high-growth states: States like Arizona, California, Hawaii, and Delaware are still experiencing significant rent increases—not surprising in markets with growing populations and economic opportunities but limited housing supplies.

- Ongoing affordability challenges: Although the rate of rent growth may slow down, rental prices are still rising and affordability remains a crucial concern in many parts of the country—especially in major metro areas.