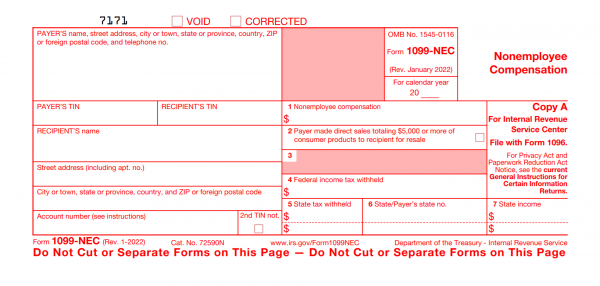

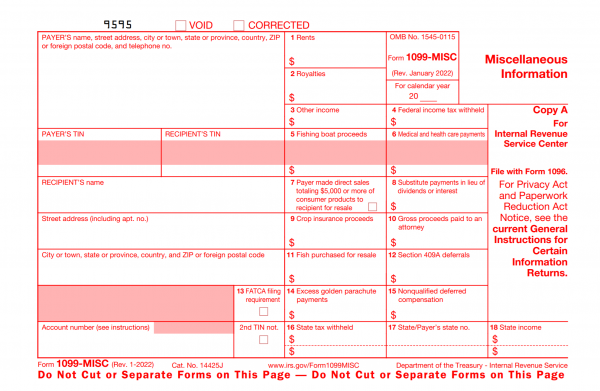

Important Announcement | The IRS changed the 1099 MISC and reintroduces the newly required 1099 NEC form last tax season and those changes are still in effect. A variety of changes have been implemented, but most notably the 1099 NEC form has been resized and the calendar year is now a fillable field (see screenshots below).

End of year bookkeeping tasks are one of the biggest stressors for property managers and that includes getting prepared for sending out 1099s.

Last year, the IRS has made significant changes to the 1099 forms and deadlines; from changing the 1099 MISC form to reintroducing the 1099 NEC (nonemployee compensation) form.

As the IRS requires property managers to issue a 1099 tax form to owners, contractors, and professionals who received more than $600 related to rental business activity, it’s important to know the details of those form changes, deadlines, and requirements.

What is a 1099 and Why Does the IRS Need Them?

The IRS relies on 1099s to monitor outside and miscellaneous income sources that are not recorded on a traditional W-2 form which reports on salaries and wages. This means that 1099s are a way for the IRS to capture independent contractors or property owner’s income that might otherwise go unreported. While a property owner or independent contractor is required to honestly report all earnings, the IRS relies on you to help reinforce the required income reporting information.

1099 Reporting Related to Property Management

For nearly three decades, the 1099 MISC was the only form to report all payments of $600 or more to owners for rents received and for the work service providers performed related to the rental business. However, last year the IRS decided to revive the 1099 NEC (nonemployee compensation form) and subsequently revamped the 1099 MISC which in essence separates out those two groups.

Who Gets a 1099 Form?

Use this form to report payments of $600 or more to gig workers, independent contractors, unincorporated service providers, and vendors (individuals or LLCs) that performed work for you related to the rental business. This can include:

Repairmen

Plumbers

Carpenters

Landscapers

HVAC professionals

Locksmiths

Cleaning services

COVID-related services such as sanitizing services

Current 1099 NEC Form Design

The 1099-MISC form there are two reasons a property management company or landlord will use the 1099 MISC form is to report payments of over $600 in a calendar year for:

- Rent sent to owners (owner disbursements, also called owner distributions) and

- Attorney fees such as to handle an eviction or collect unpaid rent (even if the legal services were provided by a corporation).

The Redesign Changes

In addition to other 1099 changes, in relation to property management, the following 1099 MISC boxes changed according to the IRS:

- Report gross proceeds to an attorney in box 10.

- And for those submitting combined federal and state forms, box 15 is to report state taxes withheld, box 16 is the state identification number, and box 17 is for the amount of income earned in the state.

Current 1099 MISC Form Design

Special Note: Because of the 1099 changes last year, if you are behind in filling out the previous years 1099s, be sure to contact your accountant and/or the IRS for detailed instructions.

1099 Filing Exemptions

No need to file a vendor or owner 1099 when the payments in a calendar year total less than $600 or were made to purchase goods not services. In addition, there are a few additional exceptions to the 1099 requirements for property managers

1099-MISC Exception: 1099s need not be filed if the rental property owner is a corporation. This means if a corporation owns the rental property, you do not need to submit a 1099 MISC form to document owner distributions sent to the corporation.

*This exception only applies if the property (or property portfolio) has been set up as a corporate entity. It does not apply to attorney fees paid to a legal corporate entity. Attorney fees over $600 require to be submitted on a 1099 MISC form regardless of business structure.

1099-NEC Exception: Payments to an incorporated business who perform maintenance, repairs, or other services related to a client’s rentals are exempt from receiving a 1099-NEC form.

Important Note: The IRS has complex rules and with that, the exceptions above have exceptions and nuances that go beyond the scope of this article. For example. a vendor operating as an LLC can opt to be treated as C or S corporation for tax purposes and so is also exempt from receiving 1099s in many cases. To be sure you are offering 1099s appropriately, be sure to check current IRS instructions, consult a tax advisor, and have current W9s on file to help you determine if the company is exempt or not.

Helpful Resource: 2021 Instructions for Forms 1099-MISC and 1099-NEC

What Information Do I Need to File 1099s?

For each individual or entity that you intend to file a 1099 for, you will need their:

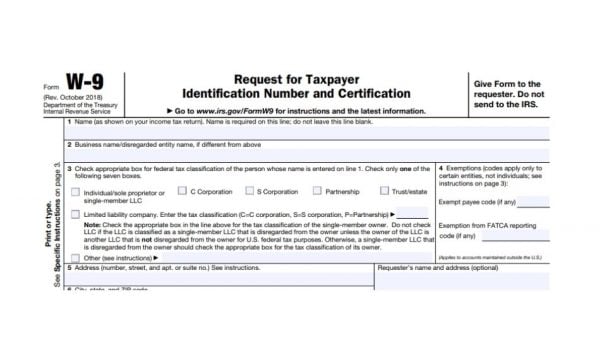

Tax ID Number | For individuals, this is their social security number (SSN), for businesses, it’s their employer identification number (EIN).

Address | This allows you to send the recipient a required copy for their tax reporting requirements.

Funds Paid | You will need to know the cumulative amount of money issued to the individual during the tax year. Your owners’ and vendors’ tax ID number and address can be captured via a W-9 form. A W-9 form is an official IRS document used to request and certify a taxpayer’s identification number and address. 1099 Time-Saving Tips

1099 Time-Saving Tips

- It is always a good idea to require a vendor or owner to fill out a W-9 when you first engage in business with them so you do not have to scramble for this information come tax reporting time.

- Asking for an updated W-9 yearly will ensure you always have their most current address and information and aren’t caught surprised by any changes in their business.

- It’s not too late to send a W-9 to owners and vendors before 1099s are due. IRS W-9 information, instructions, and .pdf form can be found here: About Form W-9

1099 Requirements for Rental Owners

If you self-manage the rental property you own, you may wonder about your 1099 requirements. Back in 2009, a clause in the Affordable Care Act required rental owners to report 1099-MISC income paid to service providers in relation to the rental property. In 2010, the clause was further clarified with the Small Business Jobs Act and the Health Care Reform Bill. BUT, by 2011 the requirement was repealed, making it not necessary for private landlords to file 1099s to vendors for work related to their own rental property.*

*That said, the penalties for failing to file 1099 tax documents are high, so you should always speak with a tax professional who is familiar with rental real estate tax requirements if you have any questions or require further clarification.

When are 1099s Due?

Federal 1099-NEC Deadlines

Both the IRS and recipients must receive their respective copies (regardless or filing by paper or electronically) on or before January 31, 2022.

Federal 1099-MISC Deadlines

The 1099-MISC copy must reach the IRS and recipient on or before February 28, 2022 if paper filing, or March 31,2022 if you file electronically. Note: If you report any amounts in box 8 or 10, the deadline is February 15, 2022. This also applies to statements furnished as part of a consolidated reporting statement.

More information on due dates can be found on the Guide to Information Returns on page 26 of this IRS publication | 2021 General Instructions for Certain Information Returns

Remember, the penalties for failing to file 1099s can be costly so it is important to understand your obligations when it comes to 1099 requirements for your rental business. It’s always recommended that you speak with your accountant or a tax professional with specific questions about your taxes and upcoming deadlines.

How do I File 1099s for my Property Management Business?

As both the 1099 MISC and 1099 NEC have different IRS filing deadlines and yet those deadlines are different from when the recipient must receive them, it can become complicated to coordinate that timing.

The simplest way to file your 1099s with the IRS and send them out to recipients is to do so electronically, or e-file.

Of course, you also have the option to mail 1099 Tax Forms to the IRS, however, any business that submits more than 250 1099-MISC Forms must file electronically.

Property management software, like Rentec Direct, makes it easy for property managers to complete 1099s and meet your tax reporting requirements. Your property management software should always have integrated accounting features that records owner and vendor payments made throughout the year and will generate easy-to-read reports summarizing your vital tax reporting information.

The right software will provide you with a way to file your reports online from your account (e-file) or print out a tax assistant report to give your CPA or use for manually filing 1099s.

Want to use Rentec Direct to electronically file your 1099 tax documents? It’s easy with the 1099 Tax Assistant and integrated e-file functions. Property managers and landlords can find convenient e-filing options for 1099s within their rental management software.

Through services like Rentec Direct, 1099s are automatically generated based on your financial records and vendor payments recorded throughout the year, so sending 1099s to recipients and filling them with the IRS is a breeze.

This updated article originally posted 12/04/2020 and is to help understand the 1099 changes and does not constitute legal advice. Please consult with your tax professional regarding your 1099 obligations and deadlines.

Help please. Should a landlord who has hired a property manger for taking care of his/her rental properties issue 1099-MISC or 1099-NEC to the property manger if the management fee is over $600? Or is there no need to issue either form?

Great question! If they are not an employee or a corporation, then most likely yes. If not an employee, it is always recommended you require any contractor or business to fill out and return a W9 form to you. They will have the opportunity to indicate on that form their status and any exemption they may have to the 1099 requirement. Having that on file could protect you if you are audited.

If you find they are not exempt, I found this article stating a PM company should be issued a 1099 but not to include reimbursed expenses in the amount. I would think that would also apply to an independent contractor. Because I can’t offer legal or tax advice, I would recommend you check with your accountant to confirm. Hope this helps!

what if you just bought a housse and became a landloard in 2021 wouldnt i have to wait to file my 2021 taxes in 2022 to fill out a w9n as a land lord

Hi Jess, You’ll have to speak to your accountant about when and what to file but a W9 has a different purpose. A W9 is a form that is kept on file by a taxpayer (such as a business, brokerage, financial institution, property management company) required to report payments to you (rent, interest, etc) on a 1099 form each year. For example, if you are hiring a property management company to manage your house, they will likely ask you to fill out a W9 form for them to keep on file. This form indicates your company structure, tax identification, and other information they might need to set you up within their software. Then, that information is used to process a 1099 they are required to send you next year to help you file your taxes. I hope that helps.

Changing the tax forms was so difficult for us, to be honest! My accountant and I were just in the process of buying… You are a big hero for helping us with advice.

Help please. I have two rental properties with the same management company. I only received a cumulative 1099-MISC but when I file my taxes, I need to break it down per property. How will the IRS tie the cumulative 1099-MISC to those two amounts per property?

Hi Rene, It is very normal for a property manager to send just one 1099 for all properties they manage on your behalf. Provided the total sum of your income reported on your rental Schedule E’s meet or exceed the amount reported on your 1099 it should not generate any flags. Every situation is different, however, so we recommend verifying this with your CPA or a tax professional.