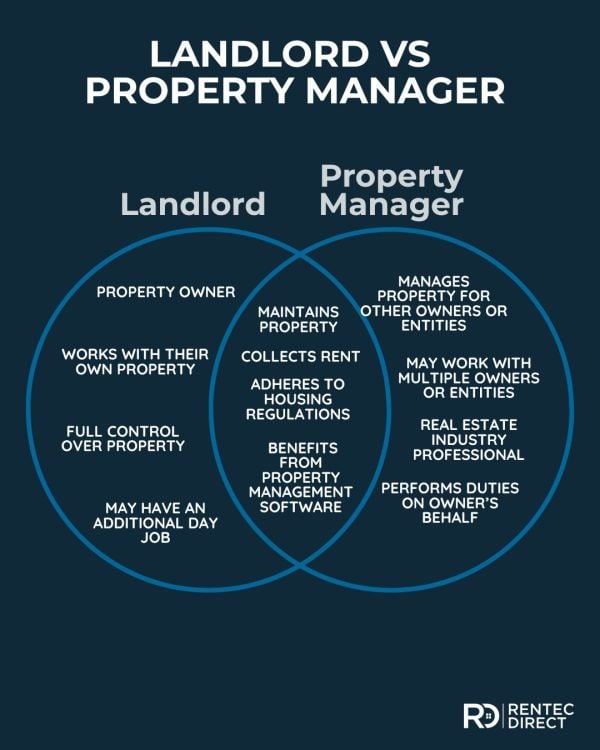

While there are similarities between landlords vs property managers, there are also some notable differences between the two, which impact legal and financial requirements. Explore these differences and what they mean for landlords and property managers.

Whether you are investing in real estate and rental properties for the first time, or you are a renter seeking a better understanding of who you are renting from, understanding the differences of landlords vs property mangers can be a helpful concept to understand. While landlords and property managers may have a lot in common, they also have a number of differences. From legal designations to requirements to operate and perform their jobs, these two positions have very unique roles in renting and property maintenance.

Understanding a Landlord vs Property Manager

The most obvious difference between these positions is that a landlord owns the property they rent out, while a property manager maintains a property owned by someone else. They will both perform similar tasks, but from a different position.

If you are a landlord and self-manage your property, you perform the functions of a property manager on your own. Tasks such as property maintenance, collecting rent, and communicating with tenants are landlord responsibilities. However, some landlords, especially those who own a lot of properties, will hire a property manager or work with a property management company to care for their properties and attend to the needs of their tenants.

If you are a property manager, you can manage multiple properties owned by several landlords. They may own their own property management firm or work as an employee of another property management company or real estate broker. Additionally, a property manager is a real estate professional who has experience and knowledge about the industry, while a landlord does not necessarily need to have experience.

Property managers will typically also have a relevant degree or a license, but some states have differing requirements. Idaho, for example, does not require a license for property management, unless under certain specific circumstances, where a real estate license would be required. These circumstances include property managers who are involved in typical real estate matters, such as the sale of property. However, the other states require either a real estate license, a specific property management license, or both. It is advised to check with your local jurisdiction if becoming a property manager is something you are interested in.

A property manager will be responsible for most of the day-to-day caretaking requirements for the property, as well as helping the landlord remain compliant with all regulations. In addition, they may also provide marketing and do much of the legwork in finding new tenants when the previous ones move out.

Learn more: Understanding Property Manager Responsibilities | A Quick Guide

Financial Differences Between Landlord vs Property Manager:

The financial side of this also carries multiple differences. A property manager needs to operate out of a trust account, meaning that, as a property manager, you have more restrictions on what you can do with the money you have access to.

Operating out of trust accounts is another significant element of the landlord vs property manager question. While it is a good idea for a landlord to have a business checking account, a property manager also needs to operate out of a trust account. This is an account where the person managing it is not the person whose money is actually in it. The beneficiary, the property owner, does not have to manage the funds in this account themselves, as oversight becomes a responsibility of the property manager trustee.

Conversely, as a landlord is operating with their own money, they do not need to use a trust account. They can operate with money directly from their personal account, although it is, as I said, beneficial to open a business checking account if you are a self-managing landlord.

Finally, profit is a noticeable difference between the two professions. A property manager will only take a small percentage of the rent from each property they manage. On the other hand, a landlord takes the entire rent payment, minus however much is needed to pay their potential property manager and maintain the property.

Learn more: Rental Property Management Trust Accounting Primer

Difference Between a Landlord and a Real Estate Investor:

Another common term that is conflated with a landlord is a property investor. An investor is someone who is primarily contributing financially to property, meaning that they have less control but also less responsibility. A landlord, however, is more directly involved in the property, even if they hire a property manager. This involvement does equate to more work for a landlord on an individual property, but it also means that they have more control over their investments than a property investor would.

Additionally, an investor is not always purchasing a property with the intent of renting it out, and may not own the property for an extended period of time, while a landlord explicitly wants to rent the property out. Investors who wish to rent out the property for passive income and do not wish to handle the day-to-day management tasks of a landlord will hire a property manager to take on this responsibility.

Where they Overlap:

There are some cases where you may be both a property manager and a landlord. For instance, you can be a property manager for others and also have your own properties, which you rent out. In this case, you would be both the landlord of your rental and the property manager of someone else’s. Other similar cases exist in which you may be able to claim both titles if you own properties that are owned by separate legal entities, but most landlords who self-manage their properties do not consider themselves property managers.

Deciding if You Need a Property Manager as a Landlord:

This depends entirely on your personal needs as a landlord. If you have multiple rentals, are struggling to keep up with the needs of your property, or have a day job, you may want to hire a property manager. However, if you are handling your properties on your own, you may choose not to spend the money. Regardless of which route you choose, you or your property manager can make use of property management software to make your job easier.

Final Thoughts:

There’s a lot of overlap between these titles, depending on what specific details your position entails. However, to put it as simply and concisely as possible, a landlord has ownership, responsibility, and control over the property; a property manager has responsibility for the property and will sometimes work with several landlords; and an investor has ownership but often little responsibility for day-to-day management tasks.