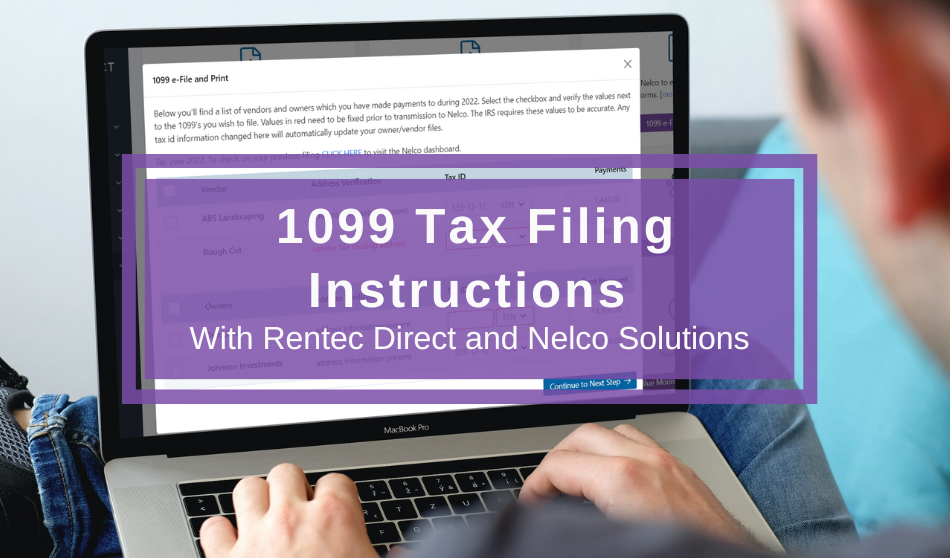

Through a secure integration with Nelco Solutions, the leading experts in tax reporting solutions, Rentec Direct software makes filing your 1099 tax documents easy.

No extra data entry necessary, no need to pay an expensive accountant, your property management software compiles all the relevant data needed to create 1099-MISC and 1099 NEC forms from your account.

With a push of a button, that data transfers from your Rentec Direct account to the Nelco Solutions site which creates the appropriate 1099 forms, mails them to your recipients, and e-files with the IRS, allowing you to meet deadlines and remain compliant with your tax obligations.

Important notice to property managers: The year before last, the IRS has changed the type of 1099 forms required to provide to any service provider or owner who received more than $600 related to their rental business. Those changes are incorporated into processing your 1099s through the Rentec Direct and Nelco Solutions integration. More information can be found in the video on how to file your 1099 tax forms with Rentec Direct below.

How to File 1099 Tax Forms with Rentec Direct

Whichever landlord software you use, having best practices for data-entry and bookkeeping not only keeps you audit-ready but should also allow you to have important tax preparation reports and documents at your fingertips. Your Rentec Direct property management software does it best by providing simple tools for filing 1099 tax forms such as the 1099 Tax Assistant and integrated e-filing solutions.

1099 Tax Assistant Report

The 1099 Tax Assistant report gives property managers and landlords the necessary information to easily and quickly review the information prior to completing the 1099 tax forms required by the IRS for vendors and owners. This is the form you will review prior to processing your 1099s with the integrated Nelco Solutions tool or give to your CPA if you choose to have them complete the forms on your behalf.

Remember, it’s crucial that your data is accurate. Before submitting anything to your CPA or the IRS, review the 1099 Tax Assistant report and make sure the numbers match your records, and verify that all receipts and payments have been reported accurately for 2022.

How to E-File Your 1099s

Nelco Solutions assists Rentec Direct clients with electronically filing 1099s directly from your software. The proper 1099 tax forms are automatically generated based on your financial records and vendor payments recorded in the software throughout the year.

Through our secure partnership with Nelco, you will connect to their portal through your Rentec Direct account and have federal and state forms sent to your recipients both by mail service and electronically as well file with the IRS.

Our friends at Nelco recently hosted a video for Rentec Direct clients to show us how to file 1099s through Rentec Direct’s simple tools. Check out the video below to find out just how easy filing 1099s within your Rentec Direct account with Nelco Solutions.

Rentec Direct and Nelco give property managers and landlords the easiest way to complete year-end tax reporting. This video shows you how to connect your Rentec Direct account with Nelco and submit your 1099 tax forms with the IRS, including recipient mailing.

Video Highlights Include:

– How to e-file your 1099 tax forms with Rentec Direct.

– Rentec Direct access and Nelco Solutions login.

– Forms and progress.

– Federal 1099 filing options.

– State 1099 filing options.

– How to email copies to recipients.

– How to print and save copies.

– How to process corrections.

– How to check the status of your filing.

So whether you are a Rentec Direct client or just curious about important information such as penalties, deadlines, and the new 1099 MISC and 1099 NEC changes, the video above may prove useful.

For Rentec Direct clients, the corresponding knowledgebase article with full instructions can be found here: 1099 Tax Forms | Federal and State E-filing and Print Options

Upcoming 1099 Tax Deadlines

This tax season, the IRS requires everyone to provide 1099s to their recipients (and in most cases file electronically) by January 31, 2023.

Check out this Nelco Solutions menu to find your specific State and Forms deadlines | State and Federal Deadlines

The penalties for failing to file 1099s can be expensive, so it is important to understand your obligations when it comes to 1099 requirements for your business.

Nelco Discount Offer

Use the code RENTEC22 to take advantage of the one free federal filing offered by Nelco Solutions when you file through your Rentec Direct account*

*1 free federal e-filing, mailing and online retrieval – expires 5/1/23

For questions about your 1099 filing requirements and how to complete your online filing through Rentec Direct, you are encouraged to reach out to Nelco at 800-266-4669 or nelco@nelcosolutions.com – Just let Nelco know you are a Rentec Direct client and are looking for more information on using the helpful, integrated e-filing solutions offered by Rentec Direct and Nelco Solutions.

This updated article originally posted 12/18/2021 and is to help understand the 1099 requirements and does not constitute legal advice. Please consult with your tax professional regarding your 1099 obligations and deadlines.